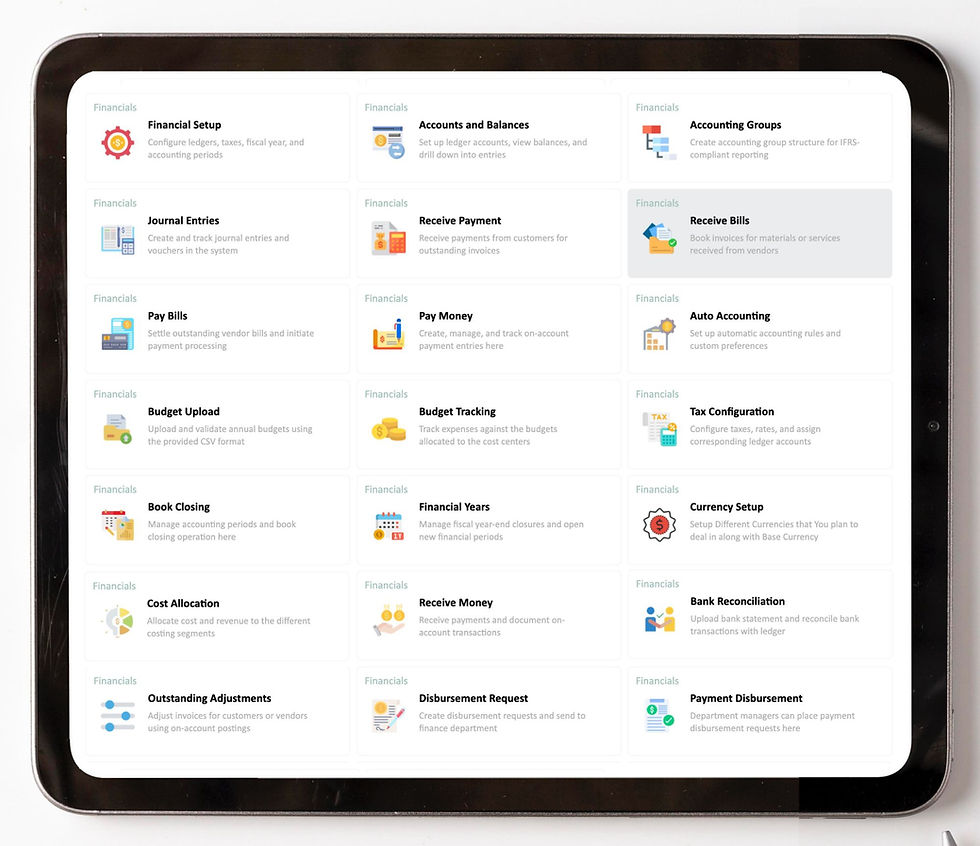

Financials Management

Gain complete control and visibility over your organization’s financial health with our fully integrated Financials Management solution. From core accounting to advanced cost control, budgeting, taxation, and compliance, the system streamlines every financial process into one unified platform.

General Ledger

Centralized financial hub capturing all transactions, enabling real-time reporting, compliance, and accurate accounting

Accounts Payable

Streamlines vendor invoicing, approvals, and payments while ensuring accuracy, compliance, and timely settlement of obligations.

Accounts Receivable

Streamlines invoicing, monitors outstanding payments, and track cash flow through integration with sales/ service contracts.

Cost Accounting

Tracks, allocates, and analyzes costs across cost centers, enabling accurate profitability insights and expense control.

Built on robust accounting principles and automated posting logic, our General Ledger ensures financial accuracy, enforces compliance, and empowers teams with real-time insights.

Key Features

Centralized Financial Control: Maintain a single, authoritative record of all financial transactions, ensuring accuracy, consistency, and complete auditability across the organization.

Automated Posting and Integration: Seamlessly capture entries from all business modules—sales, procurement, payroll, and more—eliminating manual data entry and reducing errors.

Multi-Dimensional Reporting: Analyze financial data by cost center, department, project, or business unit, enabling granular insights and informed decision-making.

Flexible Period Management: Open, close, or adjust accounting periods independently, with full control over transaction postings and secure user access.

Real-Time Financial Visibility: Access up-to-the-minute profit and loss, balance sheet, and ledger summaries for accurate, timely financial oversight.

ACCOUNTS PAYABLE

Streamline Payables with Accuracy, Compliance, and Efficiency

Our Accounts Payable module automates the entire vendor payment cycle, from invoice capture to payment processing, ensuring accuracy, compliance, and timely execution—while providing real-time visibility into payables, cash flow, and vendor relationships.

Multi-Channel Bill Booking with Automatic Matching

Automatically match vendor invoices against Purchase Orders, Goods Receipt Notes (GRN), and Service Contracts to ensure accuracy and control.

Intelligent Invoice Processing and Offsets

Capture line-level charges (insurance, freight, duties, handling), apply debit notes, and offset advances against outstanding bills to keep vendor statements clean.

Vendor Payment Request & Approval Automation

Streamline payment initiation by enabling departments to raise electronic payment requests. Eliminating scattered emails and manual follow-ups.

Payables Intelligence and Actionable Visibility

A dedicated AP dashboard shows open POs, unpaid bills, pending adjustments and aging by vendor — with drill-downs to bill and transaction level.

ACCOUNTS RECEIVABLE

Automate Receivables. Boost Cash Flow.

Our Accounts Receivable module automates invoice generation from sales and service contracts, tracks payments efficiently, manages credit, and provides real-time visibility into outstanding receivables to optimize cash flow and customer relationships.

Automated Invoice Generation

Generate tax-compliant invoices automatically from sales orders, material dispatches, and service contracts, eliminating manual entry and speeding up billing cycles.

Multi-Channel Receivable Booking

Record receivables from product sales, service contracts, and project billings with seamless integration to General Ledger for accurate financial reporting.

Credit and Payment Management

Monitor customer credit limits, apply payments (partial or full), and handle advance receipts while ensuring accurate allocation against outstanding invoices.

Real-Time Receivables Dashboard

Track open invoices, overdue payments, and pending receipts with detailed drill-downs by customer or invoice to enhance collections and cash flow mgmt.

COST ACCOUNTING

Unlock cost insights. Optimize spending. Maximize profitability.

Our Cost Accounting & Budget Control module provides detailed tracking, allocation, and analysis of costs across departments, projects, and cost centers. It enables flexible budgeting with monthly or quarterly breakdowns, automated expense allocation, and real-time variance monitoring—empowering organizations to control spending and improve profitability.

KEY CAPABILITIES

-

Multi-Dimensional Cost Tracking: Capture and analyze costs across departments, projects, business units, and cost centers for detailed financial insight.

-

Hierarchical Cost Center Management: Create parent–child relationships among cost centers to view consolidated and granular profit & loss reports.

-

Automated Cost Allocation: Define allocation rules to automatically distribute shared expenses across multiple cost centers based on fixed percentages or usage metrics.

-

Flexible Budgeting & Breakdown: Upload annual budgets with optional monthly or quarterly breakdowns to closely monitor and control spending.

-

Real-Time Variance Analysis & Reporting: Compare actual costs against budgets instantly, highlight deviations, and drill down into details for proactive financial management.